Guide to European Crypto ETPs: What the Lido Launch Means for Web3

Summary: The launch of the Lido-staked Ether ETP opens a new chapter for Web3 assets entering traditional markets. Learn how this regulated product works and what it reveals about bringing Web3 yield products into Europe’s regulated investment landscape.

Authors:

Pavel Batishchev

Managing partner

The Launch: Lido, WisdomTree, and Europe's First stETH ETP

The launch of the WisdomTree Physical Lido Staked Ether ETP marks a major development at the intersection of crypto staking and regulated finance. Developed in partnership with Lido, Ethereum’s leading staking protocol, the product allows traditional investors to gain exposure to stETH and staking rewards.

The new product is marketed as the first physically backed stETH crypto ETP and is listed on Europe's leading traditional security exchanges: Deutsche Börse Xetra, SIX Swiss Exchange and Euronext Paris/Amsterdam.

Why It Matters: A Milestone for Web3 Integration into Traditional Finance

For investors, the new Lido Ether ETP provides a straightforward way to access staking economics without leaving the comfort of a brokerage account. A user who would never interact with a wallet or DeFi application can gain exposure to stETH’s yield in a form their existing advisors and platforms can work with. While it won’t replace on-chain tools, it’s a clear signal that Web3-native assets are becoming accessible via traditional financial channels.

The launch of Staked Ether ETP is a noteworthy moment for the Web3 space: a core on-chain asset is now traded, custodied, and accessed through the same market infrastructure used for traditional financial products. What’s interesting, though, is that there’s nothing exotic about how the product is built. It uses a fairly standard European ETP structure – custody, a prospectus, and distribution arrangements.

And that’s the real takeaway for Web 3 builders: this isn’t something only large protocols can do. If you run a yield-bearing token or a similar product, you can explore a smaller-scale version – maybe just a single listing on a venue like Börse Stuttgart – as long as you understand the legal requirements and operational setup.

Deconstructing the Crypto ETP: From On-Chain Asset to Regulated Security

If you strip away the legal jargon and investor-facing language, a European crypto ETP is a very simple machine. It’s a set of legal and operational components wired together to turn an underlying asset into a security that can trade on a regulated exchange. The same blueprint is used for gold, baskets of commodities, FX certificates, and, increasingly, digital assets.

It’s important to understand that the underlying asset does not need to be a security – and creating an ETP based on a specific asset does not automatically change its classification to a security.

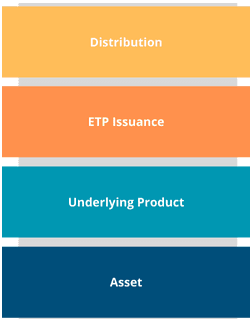

The ETP stack is composed of several layers, each designed to fulfill a specific role within the product’s lifecycle. These layers interact through clearly defined interfaces, ensuring operational clarity and regulatory compliance.

Layer 1: The Asset

At the foundation sits the asset or portfolio of assets the ETP intends to track. In the Web3 context, this could be a liquid staking token, a yield-bearing stablecoin or a portfolio of crypto assets.

From the perspective of an issuer or exchange, the asset must behave predictably, be holdable by institutional custodians, and have clear, continuous market prices.

Layer 2: The Product

Above the asset comes the product layer, containing the legal structure that actually owns and manages the underlying asset.

This layer usually consists of a segregated and bankruptcy remote SPV, or a compartment (segregated portfolio) within a larger issuance platform, or in some setups, a fund-like structure, often in jurisdictions like Cayman Islands, Jersey, Guernsey, Ireland, or Luxembourg.

Inside this layer we find all functions related to holding and managing the collateral – underlying assets, – including:

- A custodian – actually safekeeps the assets.

- A security trustee / security agent – holds a legal charge over the collateral (assets) for the benefit of investors and ensures assets remain protected if the issuer defaults.

- An administrator / calculation agent – calculates NAV, valuations, produces reports.

- An auditor (if mandated) – validates statements and verifies asset holdings.

Crucially, this is the layer where the strategy lives. If the product is actively managed, the SPV ( appoints an asset manager which makes discretionary decisions.

Layer 3: The ETP Issuer

This is usually done through the professional issuance platform based in Switzerland, Liechtenstein, Jersey, or Luxembourg. The issuer typically maintains a base prospectus (public offering documentation) approved by a regulator, which allows it to issue many different ETPs under the same program.

The issuer does not run strategies. That function belongs entirely to the product-level structure that holds the assets. The issuer’s role is purely regulatory and structural: it creates the notes or certificates, manages disclosures, interfaces with exchanges, and ensures ongoing compliance.

Supporting infrastructure here may include the bank and paying agent, which handle interactions with clearing systems for settlement and payments.

Layer 4: Listing and Distribution

Once the crypto ETP has been issued and the market infrastructure is in place, the final step is admission to a trading venue.

At this stage the security receives an International Securities Identification Number (ISIN); it provides a universal, standardized identifier for a financial instrument, ensuring that the exact security can be recognized unambiguously across exchanges, countries, custodians, brokers, settlement systems, and trading platforms.

Exchanges such as Xetra, SIX, Euronext, or regional markets like Börse Stuttgart act as the public interface for the product. They do not interact with the on-chain asset at all; instead, they work with the issuer, the approved prospectus, and the market makers who provide liquidity.

At this stage, the security is also integrated into the clearing and settlement system, and made eligible for processing through Euroclear, Clearstream, or another CSD (i.e., a central securities depository). This is what transforms a product from a legal structure into a tradeable instrument.

Once listed, the ETP becomes accessible through the distribution channels that the broader financial system already uses. Brokers, private banks, wealth managers, and institutional platforms can route orders, hold the product in client accounts, and include it in portfolios without needing to engage with Web3 tooling.

For a Web3-originated asset, this layer is what makes it “bankable”: it allows the asset’s economics to circulate through traditional investment pipelines, significantly broadening its reach beyond native crypto users.

What This Means for Web3 Builders, Teams and Protocols

The Role of the Web3 Builder in an ETP Structure

For a Web3 builder or team, entering the ETP ecosystem means stepping into the role traditionally known as the originator. The originator is the source of the idea, strategy and the underlying value proposition.

In a Web3 context, the originator is usually a protocol team, a DeFi project, curator, on-chain strategy provider, or a builder who has created a token, yield mechanism, or methodology that can serve as the economic engine of an ETP.

Originators are typically not regulated investment firms; they provide intellectual property, technology, or strategy. Instead, they partner with an issuer and integrate their asset or strategy into the regulated structure built downstream.

How Web3 Teams Can Earn from ETPs Without Becoming Regulated

Because originators are usually unregulated their economics do not sit at the issuer layer. Instead, they are embedded directly in the product-level vehicle, the same layer that holds the collateral and executes the strategy.

The originator’s compensation typically comes in the form of a strategy fee, a licensing fee for the use of their methodology or index, or a performance-linked fee if the strategy is actively managed. These fees accrue at the product level and flow through NAV like any other operational cost.

In this way, Web3 teams can participate financially in the success of the ETP without becoming regulated entities themselves, while the issuer remains responsible for the regulatory and listing obligations.

The WisdomTree x Lido ETP launch isn’t just a product release – it’s a clear proof of concept. It demonstrates that Web3-native assets can be packaged, regulated, and distributed using the same robust legal and market infrastructure that supports ETFs, gold ETPs, and FX products. For protocol teams and DeFi innovators, this unlocks a new go-to-market strategy: build on-chain, distribute off-chain. The roadmap is now public – and it’s bankable.